- Quickbooks self employed review how to#

- Quickbooks self employed review update#

- Quickbooks self employed review upgrade#

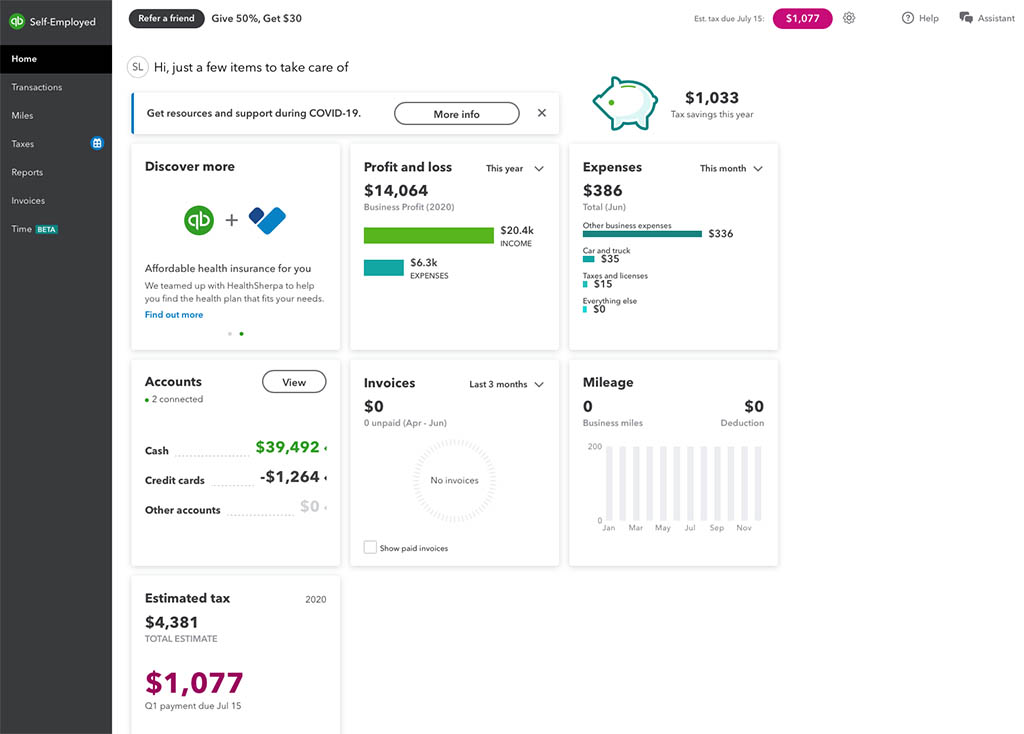

This will create an estimated amount to pay the IRS for taxes. Track Info: QuickBooks Self Employed record and categorize transactions and include them as a part of your federal estimated quarterly tax payments. You have to categorize them to correctly show up in the Schedule C category and on your financial reports. It will automatically download your latest transactions. Put your expenses into the correct Schedule C and categorize transactions, and easily transfer Schedule C income and expenses.Īdd business transaction: You can easily add transactions into QuickBooks self-employed by just connecting your bank and credit card accounts to QuickBooks self-employed. You Easily organize income & expenses for instant tax filing.įile taxes: Instantly transfer your financial data entry by connection to TurboTax Self-Employed. You can also snap a photo of your receipt and forward it directly from your mail.Įstimate taxes: With the automatic reminders of quarterly tax due dates you can avoid your late fees. Expenses are categorized automatically and you seamlessly enter your transaction information. Organize receipt: You can organize your receipt and keep it ready for tax time. Also, save time taxes by tracking all expenses in one place. Sort expenses: You can easily import expenses from your bank account directly and sort business from personal spending. The mileage data is saved and categorized to maximize deductions. Track mileage: With automatic mileage tracking you can track miles without draining your phone’s battery. It helps you to keep track of your income and expenses. QuickBooks Self-Employed is a tax software that is connected to a cloud-based system that helps you to explore the benefits. QuickBooks Self Employed Features of QuickBooks Self-Employed You can sync your data and access your accounts from a web browser or mobile app.

It helps in tracking income, and mileage and staying in control of your finances at tax time. QuickBooks self-employed is a business tool for freelancers, contractors, and sole traders. QuickBooks Self-Employed Video tutorials & Support.System Requirement for QuickBooks Self-Employed.Pros and Cons Of QuickBooks Self-Employed.

Quickbooks self employed review how to#

Quickbooks self employed review upgrade#

How to Upgrade to the QuickBooks Self-Employed and TurboTax Self-Employed bundle.Plans and Pricing Of QuickBooks Self-Employed.How to Write Off An Invoice In QuickBooks.

Quickbooks self employed review update#

0 kommentar(er)

0 kommentar(er)